are delinquent taxes public record

Refer to your tax bill or call. If you have delinquent taxes due you will receive your uncertified document back with your check and a tax statement showing the delinquent taxes due.

View the tax delinquents list online.

. If the amount due is not paid by 500 pm. Delinquent Taxpayers over 5000. Florida Delinquent Taxpayers The Florida Department of Revenue is authorized by law Section 213053 19 Florida Statutes to publish the names of taxpayers who have large unresolved tax liabilities.

Public Records Delinquent REAL Tax Information. Legal Description Search Real Property vs. Additionally if you do not pay your delinquent taxes your balance is going to continue to grow.

The warrant or lien is a public record filed with the Clerk of Court or other government office. 2020 XLSX 2019 XLSX 2018 XLS 2017 XLS 2016 XLS 2015 XLS 2014 XLS 2013 XLS 2012 XLS 2011 XLS 20022010 XLS 19942001 XLS. Eventually the lien owners may have to force foreclosure on the property to pay the liens.

Typically a tax lien is placed on the property by the government when the owner fails to pay the property taxes. Return to the IRS Data Book home page. Taxes are due March 1 through October 15.

At that point you could take possession of. The warrant or lien is a public record filed with the Clerk of Court or other government office. Once a property tax bill is deemed delinquent after March 16th of each year a 15 past due penalty is added to the bill and the bill is sent to the Delinquent Tax Office.

Public Auction Tax Sales. Whats more the tax office must advertise delinquent tax liens in the name of the January 6 record owners and not in the name of prior owners. Are delinquent taxes public record.

Enter Any Address and Find The Information You Need. 101 Court Square Dewitt AR 72042. In addition to the tax return and account transcripts available through the Get Transcript tool you may also request wage and income transcripts and a verification of non-filing letter.

When property taxes go unpaid or are delinquent for a period of time this is recorded by the tax assessor or tax collector. Public Records Delinquent PERSONAL Tax Information. Delinquent Collection Activities by Fiscal Year.

If the county is unable to collect real estate property taxes they are also unable to fund important government services like police protection public schooling and emergency medical services. View detailed information about upcoming San Joaquin County public auction tax sale results of the previous tax sale and list of excess proceeds from the prior auction. An additional 30 fee will be added to all real property bills and an additional 40 fee will be added to all mobile home bills if the taxes penalties and assessment fees are not paid by 500 PM on Friday April 23 2021.

Every effort is made by the greene county treasurers office to work with taxpayers who have fallen behind on their taxes. Once you receive the certified document from our office you can then make an appointment with the Register of Deeds to record the document or mail the certified document to them. Tax Record Search and Online PaymentsSpartanburg County Taxes.

You will owe the original amount as well as penalties and interest of up to 25. Every tax delinquent property is compiled together in a ledger that can be called by many names. The process may differ slightly depending on what county youre working but you can refer to the.

Search Arkansas County property tax and assessment records by owner name parcel number or address. The objection must be filed by April. Tax Department Call DOR Contact Tax Department at 617 887-6367.

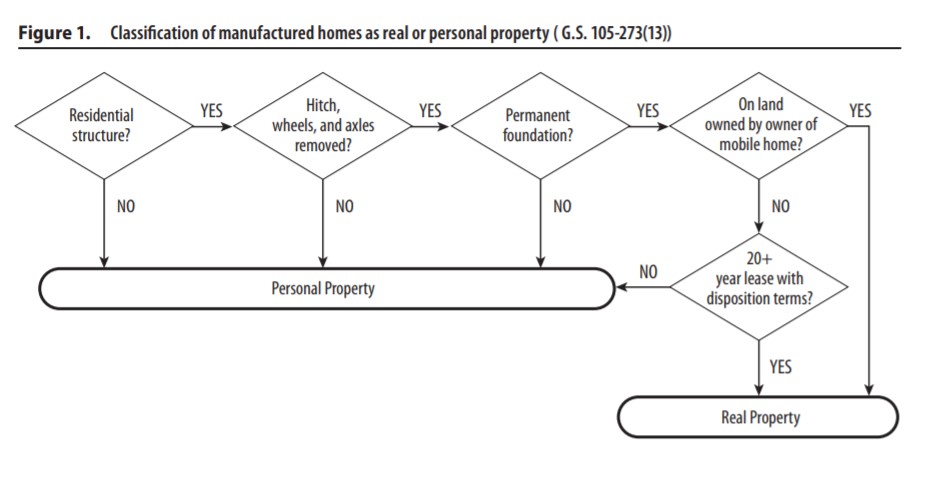

Personal Property is movable property such as business equipment and mobile homes. When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

Arkansas County Assessor and Collector. Delinquent property taxes on property located in Kirkland Washington create a serious cash-flow problem for the municipal. Records of the millard county treasurer reflect unpaid 2020 taxes certifications and attachments which became delinquent on november 30 2020 for the taxpayers and parcels listed.

If you dont even if it is only for one year you are committing a crime. The list includes taxpayers who have unsatisfied tax warrants or liens totaling 100000 or more. In either case you will need to explain very thoroughly that you want them to email the delinquent tax list to your specified email address OR mail the list to you on a CD or something similar.

Public Record Delinquent Real Estate Tax Listing. Assessor Phone 870946-2367 Fax 870946-1795. Thats the key to this real estate investment strategy.

If left unpaid the liens are sold at auctions to the public. Delinquent Taxpayer Publication - This publication lists delinquent taxpayers with prior year delinquent taxes. Visit Our Official Website Today.

Tax returns are not public record. In counties where no taxpayer has warrants or liens totaling 100000 the two taxpayers with the highest amount of warrants or liens are included. Top 100 Delinquent Taxpayer - This lists the top 100 delinquent taxpayers for the current fiscal year.

The list includes the parcel number the name of the owner of record and the amount of taxes penalties interest and costs due. Assessor Collector and Delinquent Taxes. For more details read the Departments privacy notice.

Delinquent tax records are handled differently by state. Top 100 List About Us Contact Us Employment. Delinquent Property Tax Search.

In prior editions of the IRS Data Book Table 25 was presented as Table 16. This list is published to inform all persons that the listed property is subject to forfeiture because of delinquent taxes. 44 North San Joaquin St 1st Floor Suite 150 Stockton CA 95202.

The information displayed reflects the. The property owner taxpayer or other interested persons must either pay the tax and penalty plus interest and costs or file a written objection with the District Court Administrator. Wisconsin Department of Revenue.

Its public record too. All of this information is public record. Tax returns are not public record.

Seminole County Tax Collector PO Box 630 Sanford FL 32772-0630 407 665-1000 Email Contacts Email Public Records Custodian. Search Arkansas County property tax and assessment records by owner name parcel number or address. Send a completed Form 4506-T.

9 am4 pm Monday through Friday. Contact for View the Public Disclosure Tax Delinquents List. On June 7 2021 the first Monday in June a certificate will be issued authorizing the county treasurer as trustee for the State and county to hold each property.

Property Info Taxes. The IRS requires you to file a tax return and pay the proper amount of taxes every year. Ad Looking for Corinth Tax Records.

Tax Record Search and Online Payments. Penalties are imposed as required by Utah law Section 59-2-1331 UCA. New York residents can find NY property tax records by collating accurate information about a property and taking it to their local county tax commission.

Delinquent Property Tax Search. Real Property is immovable property such as land and buildings attached to the land.

Information For Tax Sale Buyers Polk County Iowa

How To Look Up A Federal Tax Lien

Understanding Your Installment Payment Plan Ipp Bill Constitutional Tax Collector

Travis County Reveals Top 10 List Of Delinquent Taxpayers Kxan Austin

Understanding Your Installment Payment Plan Ipp Bill Constitutional Tax Collector

Arkansas Assessor And Property Tax Records Search Directory

Delinquent Property Tax Auctions Scheduled In Seven New Mexico Counties

Irs Pursues Little Fockers Star Teri Polo Taxproblemsrus

Delinquent Taxes Clark County Clerk

Charlotte Foreclosure Notice Sell House Fast Sell House Fast Foreclosures Selling House

Nevada Foreclosures And Tax Lien Sales Search Directory

Mississippi Foreclosures And Tax Lien Sales Search Directory

Real Estate Personal Property Taxes Princeton Ma

How To Look Up A Federal Tax Lien

Notice Of Delinquency Los Angeles County Property Tax Portal

Mobile Homes And Property Taxes Coates Canons Nc Local Government Law

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)